16+ Fha down payment

Affordable payments wgood credit. According to a recent report by the National Association of Realtors nearly half of consumers believe they need to pay at least 16 of the home value or more for a down payment while one in 10.

Calculated Risk December 2016

The most recognized 35 down payment mortgage in the country.

. If buying a home with an. Purchase or refinance your. Borrowers can qualify for an FHA loan with a down payment as little as 35 for a credit score of 580 or higher.

FHA mortgage insurance protects lenders against losses. With a score between 500 and. We assume a 30-year fixed mortgage term.

Down payment gifts can make it easier for homebuyers to afford a home. FHA loans with down payment assistance in Arizona are popular because of their flexibility and other benefits. September 16 2021.

There are rules that permit a borrower to receive such outside help but the source and purpose of these funds are carefully regulated under FHA mortgage loan rules. Its important to remember though that the lower the credit score the higher the interest borrowers will receive. An FHA insured loan is a US Federal Housing Administration mortgage insurance backed mortgage loan that is provided by an FHA-approved lender.

For an investment property t he maximum amount of seller concessions for any down payment is 2. A mortgage calculator can help you estimate your monthly payments and you can see how your down. Michael Kelczewski a real.

Those whose credit scores fall. We use live mortgage data to calculate your mortgage payment. Typically the home buyer purchases a primary mortgage for the full amount and pays the required 20 percent.

How to give or receive a down payment gift April 8 2021 FHA Lowers Its Mortgage Insurance Premiums. FHA mortgage applicants with credit scores as low as 580 may be approved for a home loanprovided that they have enough to cover the 35 down payment requirement. FHA loans for instance require down payments as low as 35 percent of a homes final purchase price.

We have built local datasets so we can calculate exactly what closing costs will. Because this type of loan. FHA Loan Rules for Down Payment Gift Funds.

The loan to value ratio or LTV is the size of the loan against the value of the property. The rule states that you should aim to for a debt-to-income DTI ratio of roughly 36 or less or 43 maximum for a FHA loan when applying for a mortgage loan. A percentage you may hear when buying a home is the 36 rule.

If the donor wants to give more than 1600 0. But in California 2056 condo developments have been approved for FHA financing as of June 16. Second mortgages can be structured as either a standalone deal or a piggyback loan.

Compared to average credit card interest rates ranging from 16 to 20 its clear why buyers should only use a credit card for a down payment if the balance can be paid off immediately. But more than a third 38 of homeownership programs are open to eligible repeat buyers according to Down Payment Resource a company that tracks more than 2000 such programs including those. If youre in the market for a new home and want a little help dont hesitate just make sure you follow the above steps to ensure you accept such a gift in the proper manner.

The borrowers credit score can be between 500 579 if a 10 down payment is made. If you can make a 10 down payment your credit score can be in the 500 579 range. Whether you want to build a house on your own land buy an existing suburban home or if you want to apply for a home loan for a condo or mobile home there is an FHA mortgage loan for you.

This could limit your down payment options. We use mortgage loan limits down to the county level to identify if a user qualifies for an FHA or Conforming loan. The average mortgage rate in 1981 was 1663 percent.

This down payment may be expressed as a portion of the value of the property see below for a definition of this term. Rocket Mortgage requires a minimum credit score of 580 for FHA loans. FHA loans have other costs though including an upfront mortgage insurance premium and mortgage insurance.

August 28 2022 - Borrowers wishing to purchase a home with an FHA loan may need some help with the down payment. One popular low-down-payment loan program is FHA which allows a 35 down payment as long as your credit score is over 580. Therefore a mortgage loan in which the purchaser has made a down payment of 20 has a loan to value ratio of 80.

FHA loans are much more straightforward and the contribution limit is 6 based on the lesser of the appraised value and the purchase price. Todays national mortgage rate trends. Public Law 108-186 approved December 16 2003 and the ADDI interim rule at 24 CFR 92600.

With a score between 500 and 579 youll need a 10 down payment. The complaint which was filed on March 16 2020 alleged that a developer and affiliated entities and individuals violated the Fair Housing Act FHA and the Americans with Disabilities Act ADA by failing to design and construct 116 units of housing and common use areas at four housing complexes in Grand Forks and West Fargo and a rental. If the borrower has a lower score 500-579 the minimum down payment is 10 percent.

Gift letter for mortgage. FHA loans typically have a large upfront fee rolled into the loan if the buyer either chooses a 15 year loan or puts less than 22 down on the loan. While FHA loans have a low 35 down payment requirement the total cost of borrowing money as calculated in the annual percentage rate tends to be much higher for these loans.

Standalone second mortgages are opened subsequent to the primary mortgage loan to access home equity without disrupting the existing arrangement. In Illinois buyers can find 632 FHA-approved condo developments. Down payments of 25 or more.

A study of asset returns over 145 years in 16 developed countries found rental properties outperformed stocks. Down payments of 10 2499. An FHA loan requires a minimum 35 down payment for credit scores of 580 and higher.

They have historically allowed lower-income Americans to borrow money to purchase a home that they would not otherwise be able to afford. Home price the first input is based on your income monthly debt payment credit score and down payment savings. Home Plus FHA Loan Program.

Mortgage Type Loan Limits. This fee can be more expensive than PMI but can save borrowers with poor credit profiles significant money. And lets be honest if your credit score is under 580 you should probably work on paying down debts.

The USDAs Rural Development loans do not require a down-payment. On Wednesday September 07 2022 the current average 30-year fixed-mortgage rate is 602 increasing 8 basis points over the last week. To qualify for a 35 payment on an FHA loan youll need at least a 580 credit score.

Buy Manuka Honey Online For Sale Best Active Manuka Honey Price

Exhibit 99 1

Exhibit 99 1

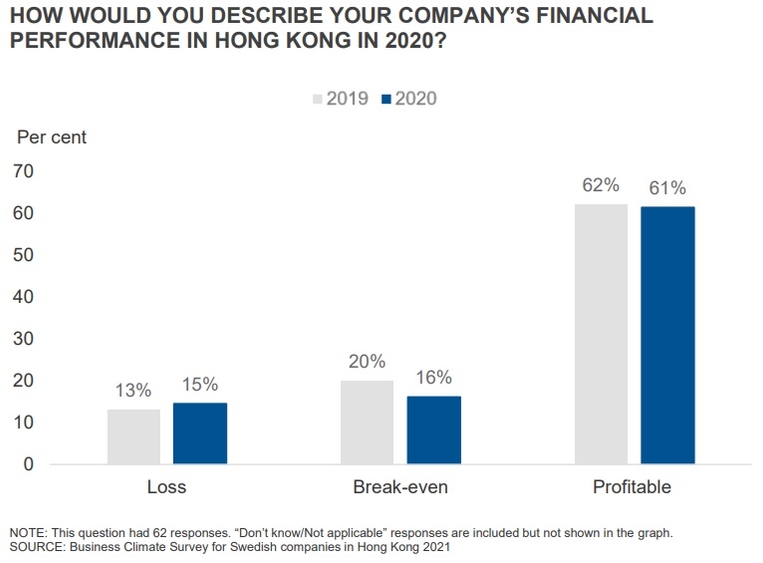

Post Covid Prospects Sweden Hktdc Research

Exhibit 99 1

10 Ways To Increase Your Money S Value Moneyunder30 Investing Emergency Fund Create A Budget

Early Termination Of Small Loans In The Multifamily Mortgage Market Pennington Cross 2020 Real Estate Economics Wiley Online Library

Calculated Risk December 2016

16 Blank Spreadsheet Templates Pdf Doc Budget Spreadsheet Template Spreadsheet Template Budget Spreadsheet

Early Termination Of Small Loans In The Multifamily Mortgage Market Pennington Cross 2020 Real Estate Economics Wiley Online Library

Early Termination Of Small Loans In The Multifamily Mortgage Market Pennington Cross 2020 Real Estate Economics Wiley Online Library

Buy Manuka Honey Online For Sale Best Active Manuka Honey Price

16 Voucher Templates Free Printable Word Excel Pdf Samples Formats Forms Designs Voucher Template Free Templates Printable Free Template Free

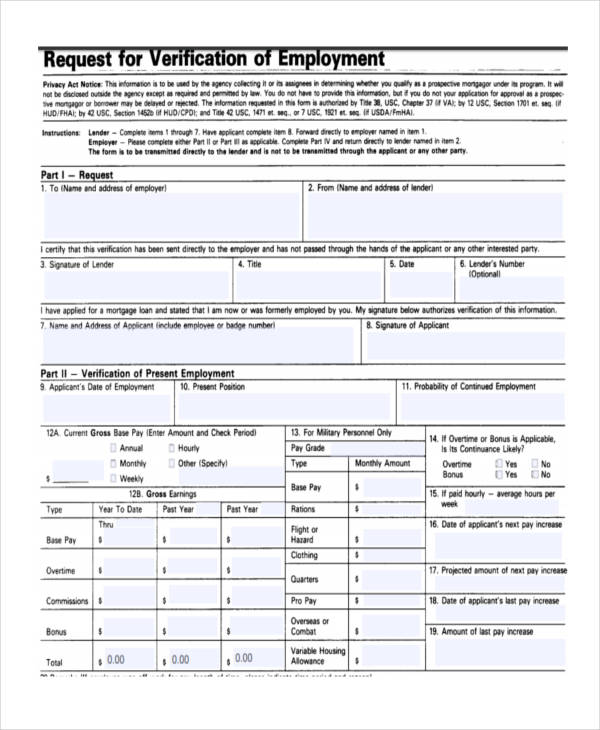

Free 8 Sample Mortgage Verification Forms In Pdf Ms Word

Exhibit 99 1

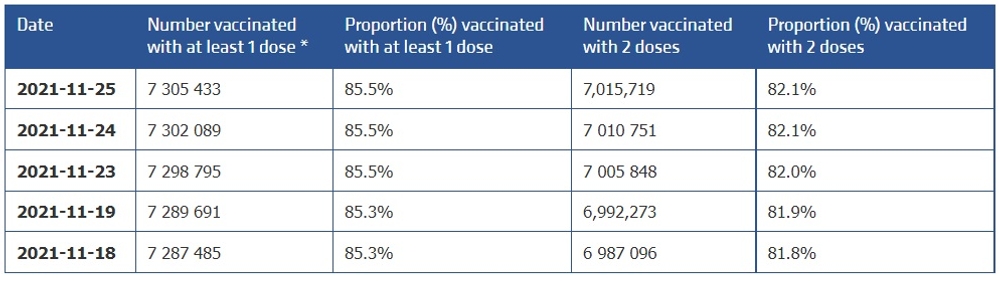

Post Covid Prospects Sweden Hktdc Research

Calculated Risk December 2016